You no longer rely on work, in the traditional sense, to support your lifestyle.

Your journey has shifted from working to working to find more time to do what you enjoy and to spend more time with friends and family.

At JourneyNest we help you make the most of what you have worked so hard for.

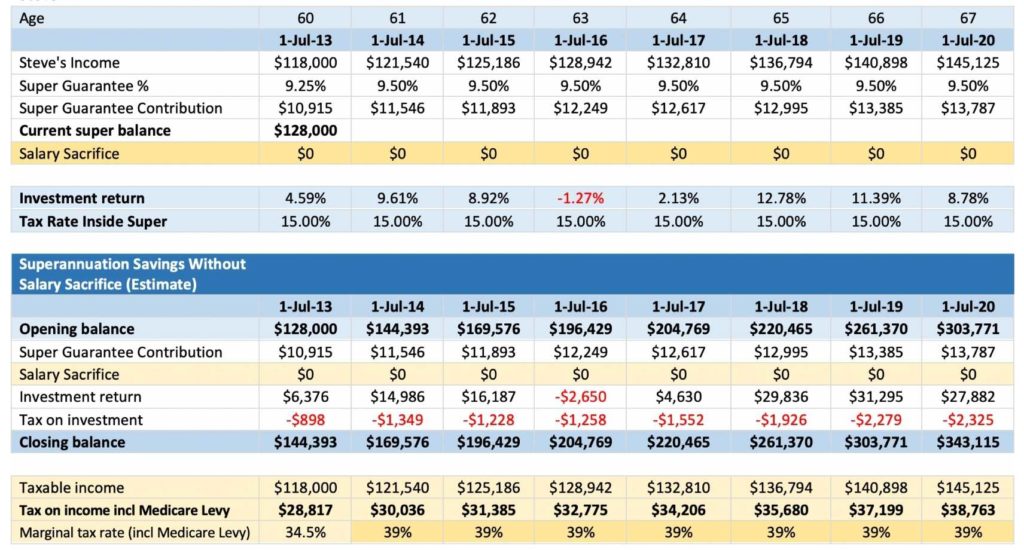

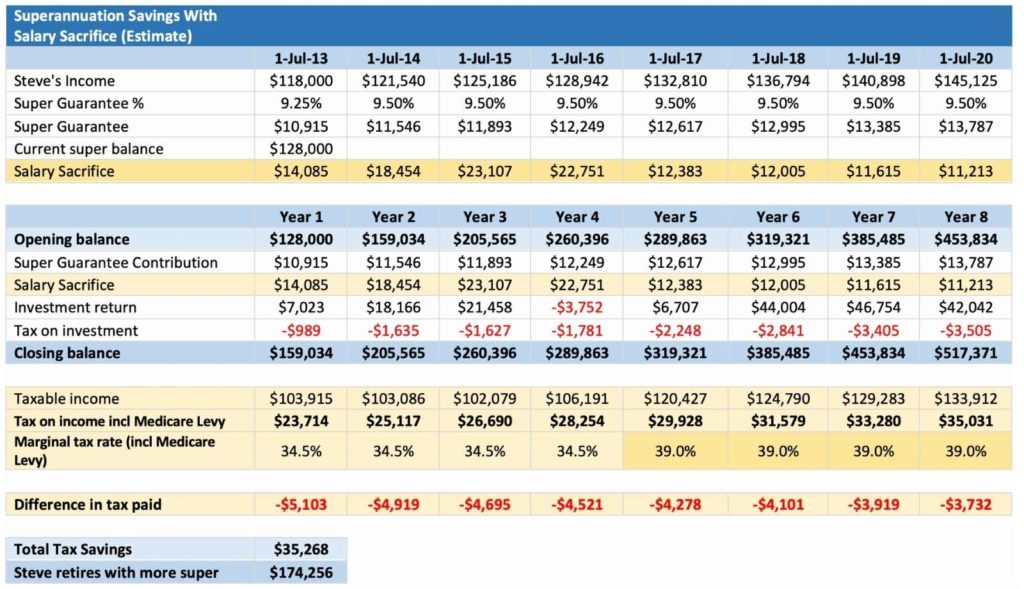

Below is an example of a scenario used for illustrative purposes.

Steve was 60 and a widower. He had spent the last 15 years taking care of his wife, working part-time to balance bringing in an income and taking care of her. After his wife passed, Steve started working full-time again.

As he approached retirement age, he wanted to be in a position to help fund his own retirement. He had seen some of his peers, and his parents surviving on the Age Pension, and it was not how he wanted his retirement to be. He was not against the Age Pension but was against relying solely on the Age Pension.

Steve was proud of the fact that he had paid off his mortgage by himself. Steve explained that he was in a good position as he lived modestly and was saving around $2,000 per month. He had invested over the years but he did not enjoy all the complexities that came with managing these. He wanted a simpler solution and one that can help him save tax.

After discussions with an adviser with JourneyNest, we developed and implemented a strategy where Steve was able to invest some of his income before tax, which resulted in tax savings. The table below illustrates how Steve was able to save some tax every year, which added up to $35,268 to his retirement savings over 8 years.

Steve

This means that when Steve reaches the Age Pension age of 67, he could bolster super savings by $174,256 resulting in a balance of $517,371 and qualify for a part pension, rather than needing to rely significantly on a full Age Pension.

This client story is a scenario only and illustrates a possible outcome based on the noted assumptions. We assumed the client was in a growth risk profile with 80% in growth asset and 20% in defensive asset (Asset class definition refer below).

Past returns are not a guarantee of future returns. It is important that you seek the advice of a professional financial planner, (such as JourneyNest) to consider your individual circumstances and objectives, outline the risks and implications of possible options and to develop your tailored advice solution.

Asset – An Asset class is a group of similar investment vehicles. Different classes or types of investment assets such as fixed interest are grouped together.

Fixed interest and cash savings are two asset classes that are used to form a defensive allocation.

Equities and properties are two asset classes that are used to form part of the growth allocation.

Past returns that the calculations has been based on:

Book a Call to discuss your situationThe purpose of this website is to provide general information only and the contents of this website do not purport to provide personal financial advice. JourneyNest strongly recommends that investors consult a financial adviser prior to making any investment decision. The contents of this website does not take into account the investment objectives, financial situation or particular needs of any person and should not be used as the basis for making any financial or other decisions. The information is selective and may not be complete or accurate for your particular purposes and should not be construed as a recommendation to invest in any particular product, investment or security. The information provided on this website is given in good faith and is believed to be accurate at the time of compilation.