At this stage of life, your priorities have shifted to planning for the next phase of life. We help you navigate through this crucial phase, managing cashflow, paying down your mortgage, building your investments, and planning for your retirement.

- You may be more established in your career or business

- Your children might be at school

- You might have paid off or nearly paid off your mortgage

Below is an example of a scenario used for illustrative purposes.

Dorothy and Jerry celebrated the birth of their only son, Ray, when they were in their mid-20’s. In their early 40’s, they sought professional advice from JourneyNest after realising they needed to seek professional guidance to establish a pathway to reaching their financial and lifestyle goals.

Ray was starting his final two years of high school at a local private school, and Dorothy and Jerry were starting to think about building their wealth. They hoped to take an extensive round the world trip in the next 5-10 years, and wanted to get their finances on track to ensure that their dream became a reality.

After discussions with their financial adviser, Dorothy and Jerry realised they were not comfortable with high-risk strategies such as taking out a loan to invest. We established that an investment plan funded from surplus cash flow and flexible enough to access funds if needed, would be most appropriate for the 10 year savings objective. Dorothy and Jerry’s objective is to look at investing the funds along with surplus cashflow and would like to maintain a level of flexibility if they needed to draw some of these funds out.

Both working as registered nurses at a private hospital, they enjoyed their work, and the flexibility of being able to schedule around Ray’s school hours. Dorothy and Jerry were earning $135,000 and $133,000 before super per annum respectively. This made their mortgage repayments manageable, and increased their personal super contributions to bolster long term savings. Accounting for all expenses and commitments, they were able to realise further surplus cashflow and savings capacity of around $5,500 per month.

Dorothy and Jerry had savings of $65,000 and wanted to maintain a $25,000 cash reserve buffer and invest the rest. Of their regular income, they were comfortable to set aside $5,000 per month to invest and looked at increasing this amount as Ray completed his education.

Together we outlined and implemented a tax effective investment strategy involving the use of an insurance bond which matched their goals and objectives of investing these funds whilst still being able to access these funds if they need to. It provided the flexibility to access funds at any time and invested in a manner that was comfortable for them. At JourneyNest we reviewed their strategy and investments regularly and took into account any changes in their personal preference of still being able to access these funds instead of locking away the funds into superannuation of which they must meet a condition of release.

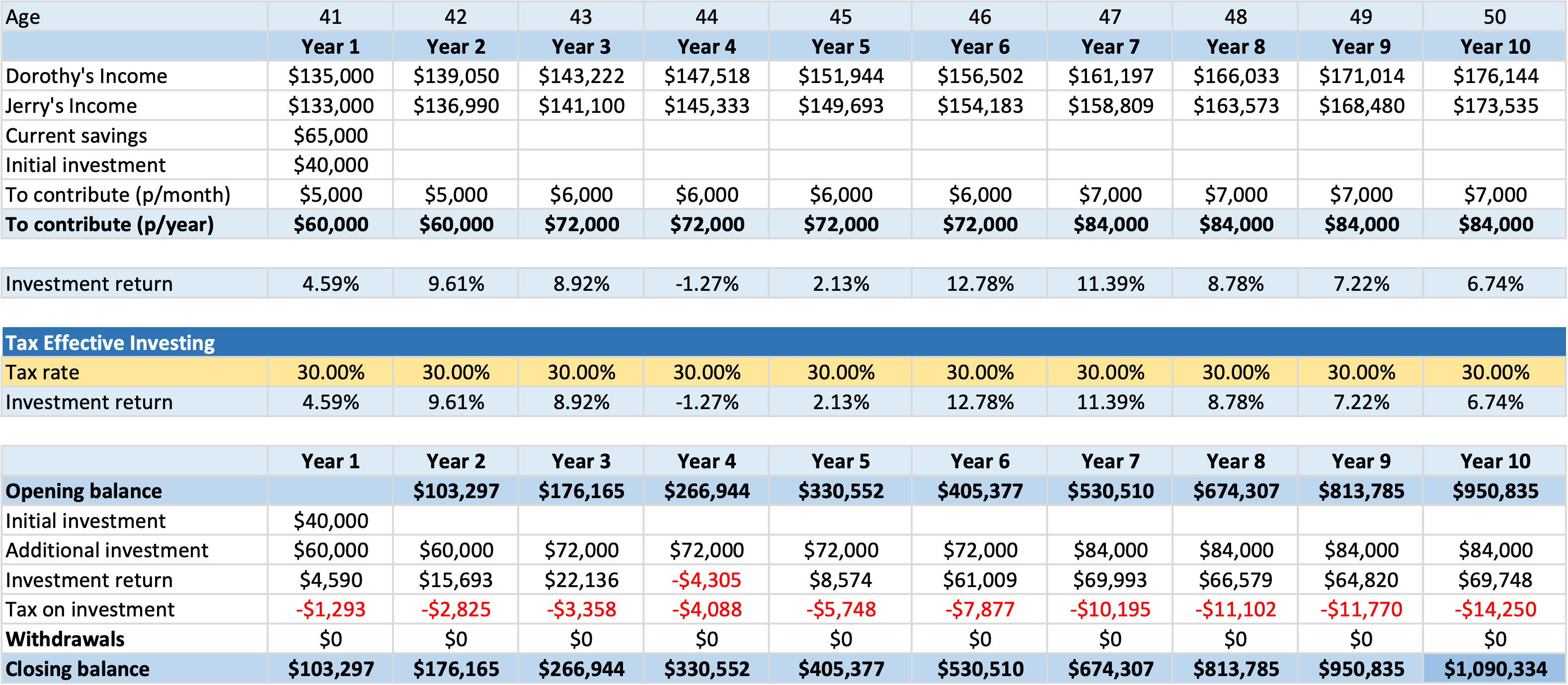

We assumed that their personal income will gradually increase over the next 10 years allowing them to increase the amount of additional monthly contributions each year. We also assumed average returns for the investment portfolio for eight out of ten years with one year return being negative and two year returns being much lower than average. The table below estimates the outcome of the investment strategy over a 10 year period based on historical investment return data (Returns 2021).

Dorothy and Jerry

After 10 years investing through a tax effective investment bond structure, we estimated total savings to be in the order of $1,100,129 which could be withdrawn tax free after 10 years.

This client story is a scenario only and illustrates a possible outcome based on the noted assumptions. We assumed the client was in a growth risk profile with 80% in growth asset and 20% in defensive asset (Asset class definition refer below).

Past returns are not a guarantee of future returns. It is important that you seek the advice of a professional financial planner, (such as JourneyNest) to consider your individual circumstances and objectives, outline the risks and implications of possible options and to develop your tailored advice solution.

Asset – An Asset class is a group of similar investment vehicles. Different classes or types of investment assets such as fixed interest are grouped together.

Fixed interest and cash savings are two asset classes that are used to form a defensive allocation.

Equities and properties are two asset classes that are used to form part of the growth allocation.

Past returns that the calculations has been based on:

Book a Call to discuss your situationThe purpose of this website is to provide general information only and the contents of this website do not purport to provide personal financial advice. JourneyNest strongly recommends that investors consult a financial adviser prior to making any investment decision. The contents of this website does not take into account the investment objectives, financial situation or particular needs of any person and should not be used as the basis for making any financial or other decisions. The information is selective and may not be complete or accurate for your particular purposes and should not be construed as a recommendation to invest in any particular product, investment or security. The information provided on this website is given in good faith and is believed to be accurate at the time of compilation.