At this stage of life, one of your most important priorities is to build better financial habits, as building blocks for a better financial future.

Professional financial advice will create a roadmap to set you on this path to financial freedom. At JourneyNest we partner with you, to understand your goals and objectives and develop a plan to bring this to life. We will help you to manage your finances with purpose over the long term.

You may be:

- Establishing yourself in your career or building a business.

- Single or a young couple.

- Starting a family.

- Looking at purchasing your first home or have a mortgage.

- Seeking ways to build your savings and achieve your financial goals.

Below we outline an example scenario.

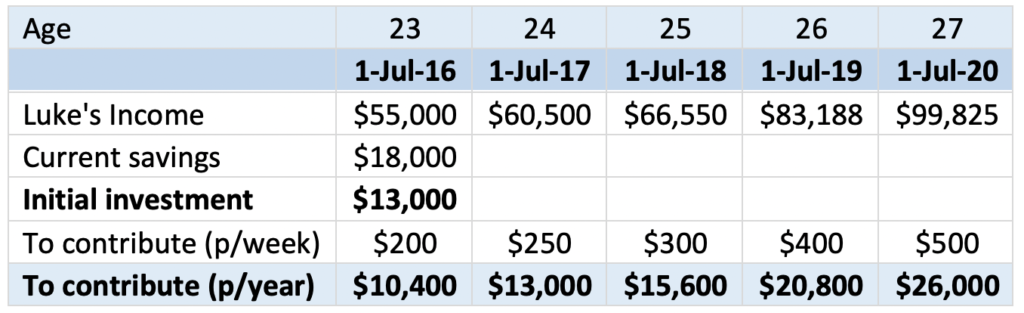

At 23, Luke was looking to save for his first home deposit, so he would no longer need to rent. Having graduated with an IT degree, Luke was in a stable job and enjoyed a salary before super of $55,000 per annum. He expected that his career would continue to progress, as would his earning capacity.

After our initial meeting with Luke, together we established an objective of purchasing a home in the medium term. Within 4-7 years, Luke planned to buy a small apartment in the city, which he anticipated would cost between $450,000 and $500,000. He aimed to achieve at least $100,000 in savings as his deposit.

In developing an appropriate strategy for Luke, it was important that we considered his personal circumstances, and his commitment to a strategy which would impact his lifestyle over the coming years. This meant establishing an investment strategy and a structured cashflow plan, to ensure his savings were directed into growth investments, which suited his risk profile.

In the first year, Luke had $18,000 in savings and wanted to keep $5,000 as emergency funds and invest the rest. He was able to save $380 per week after all expenses and was comfortable to invest $200 per week.

Through regular reviews of the strategy and his personal circumstances, we were able to identify shifts in his salary and take advantage of this by increasing the amount allocated to the regular monthly instalments into the investment plan. By working closely we not only kept Luke on track but were able to accelerate the strategy towards reaching the ultimate objective.

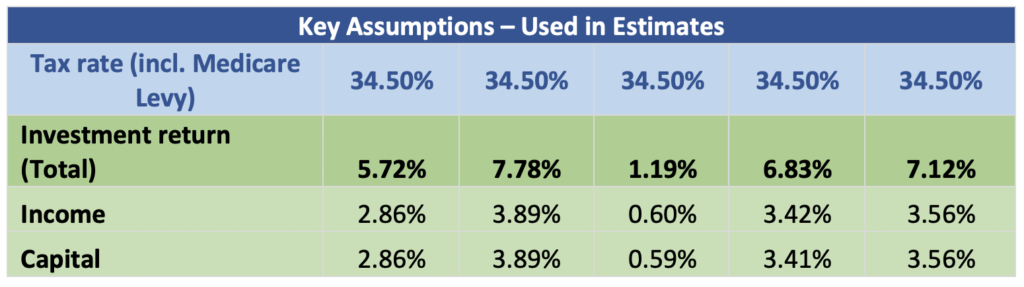

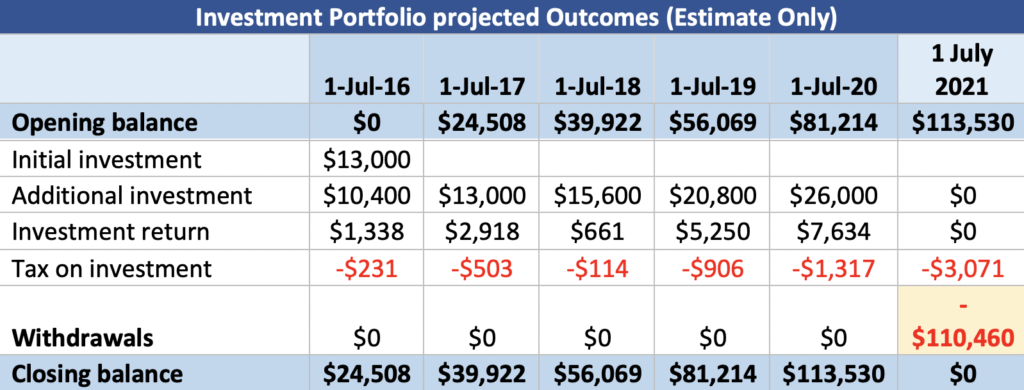

With the scenario investment strategy illustrated in this case study, we estimated that Luke would be able to realise his objective within five (5) years. We assumed that Luke’s income will gradually increase over the next five years allowing him to increase the amount of additional weekly contributions each year. We also assumed average returns for the investment portfolio for four out of five years with one year return being much lower than average. The five (5) years strategy and associated projections are outlined in the table below.

Luke

Current savings of $13,000 has bloomed to the desired end goal.

At the end of 5 years, in this example Luke would have begun with $13,000 and will have withdrew the final balance of his investment as he had reached his goal. Taking into account the returns on investment applied and the tax payable at his marginal tax rate over the period, we estimated Luke would be able to withdraw in the order of $110,460 after 5 years. In achieving the savings goal, Luke would be in a strong position to realise his goal of buying his first home.

Please Note:

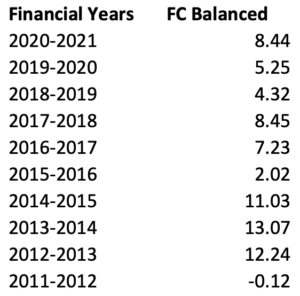

- Past investment returns are not a guarantee of future returns. The projected outcomes are based on historical investment returns and cannot be relied upon as an indicator of future investment performance.

- It is important that you seek the advice of a professional financial planner, (such as JourneyNest) to consider your individual circumstances and objectives, outline the risks and implications of possible options and to develop your tailored advice solution.

- The income tax rates (including Medicare levy) applied are taken from the ATO website (ATO: 2021) and represent the actual rates applicable in each year depicted in the example.

- The investment returns provided are past returns based on a balanced risk profile with 70% exposure to growth asset and 30% to defensive asset .(refer below for Asset description)

- The amount being withdrawn by Luke as a lump sum will be subject to capital gains tax.

ATO: https://www.ato.gov.au/Rates/Individual-income-tax-for-prior-years/

Asset – An Asset class is a group of similar investment vehicles. Different classes or types of investment assets such as fixed interest are grouped together.

Fixed interest and cash savings are two asset classes that are used to form a defensive allocation.

Equities and properties are two asset classes that are used to form part of the growth allocation.

Past returns that the calculations have been based on:

Book a Call to discuss your situationThe purpose of this website is to provide general information only and the contents of this website do not purport to provide personal financial advice. JourneyNest strongly recommends that investors consult a financial adviser prior to making any investment decision. The contents of this website does not take into account the investment objectives, financial situation or particular needs of any person and should not be used as the basis for making any financial or other decisions. The information is selective and may not be complete or accurate for your particular purposes and should not be construed as a recommendation to invest in any particular product, investment or security. The information provided on this website is given in good faith and is believed to be accurate at the time of compilation.